Authored by: Erez Katz

Background: Passive, low-cost investment products such as ETFs have been a boon for large financial institutions, endowments and index funds. These vehicles have worked quite well for most investors since the end of the financial crisis in 2008. With the enormous excess liquidity recently injected into the market and a high concentration in popular constituents, many are becoming weary of their long-only exposure vulnerability to unexpected market moves. At the same time, those contrarians who bet against the market are still licking their wounds and are becoming reluctant to short even the most ridiculously valued stocks.

In today’s writeup I’d like to present a new strategy we’ve developed exclusively for our partners at Crimson Black Capital SP, an emerging hedge fund out of the United Kingdom. Sector Hedge is a completely algorithmic investment approach geared to exploit this unique market opportunity with a long/short twist.

Model – Sectors Hedged: Sectors Hedged is a long/short, cash neutral sector rotation strategy designed to work within the major sectors of the US economy. In addition to seven of the most dominant US economic sectors, two additional asset classes have been added, namely; Value and Growth stocks.

The core holdings of the strategy are based on dominant “winners” in certain popular ETFs representing the underlying sectors and asset classes.

This multi-strategy model portfolio combines multiple individual long/short models, each representing a sector or asset class. The strategy’s goal is to generate positive returns in any market regime while avoiding large drawdowns during heightened market volatility. The Sectors Hedged strategy is predicated on the notion that, over time, the US equity market flows cyclically between sectors and asset types.

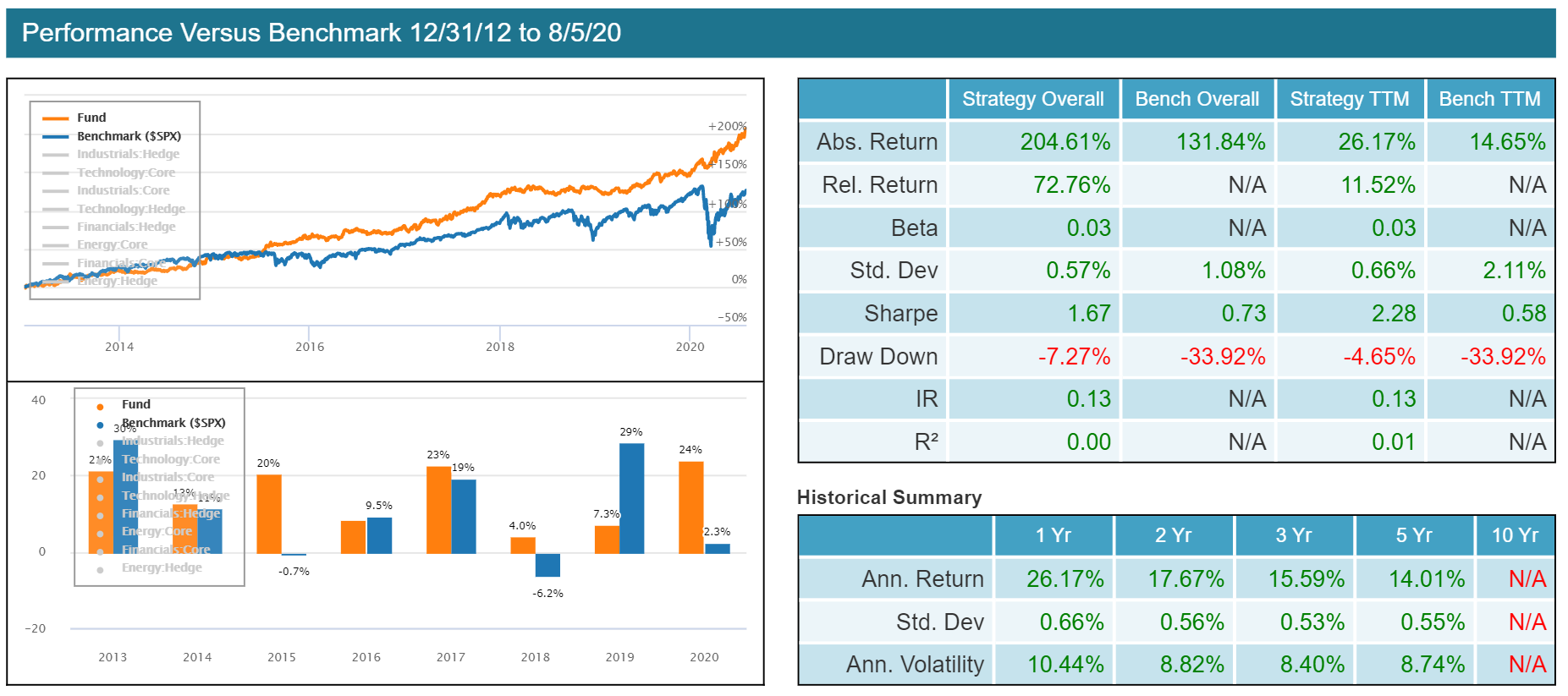

Image 1: Backtest performance of sector hedge long/short strategy against the S&P 500 as a benchmark. Performance for 1X leverage net of transaction costs and slippage. Backtest simulation results. Past performance is not indicative of future returns.

There are two layers to the portfolio construction:

- Construct an independent long/short cash neutral portfolio for each of the seven sectors and two asset classes:

- TechnologyLong/Short

- Industrial Long/Short

- Healthcare Long/Short

- Energy Long/Short

- Consumers Long/Short

- Financials Long/Short

- Materials Long/Short

- Growth Long/Short

- Value Long/Short

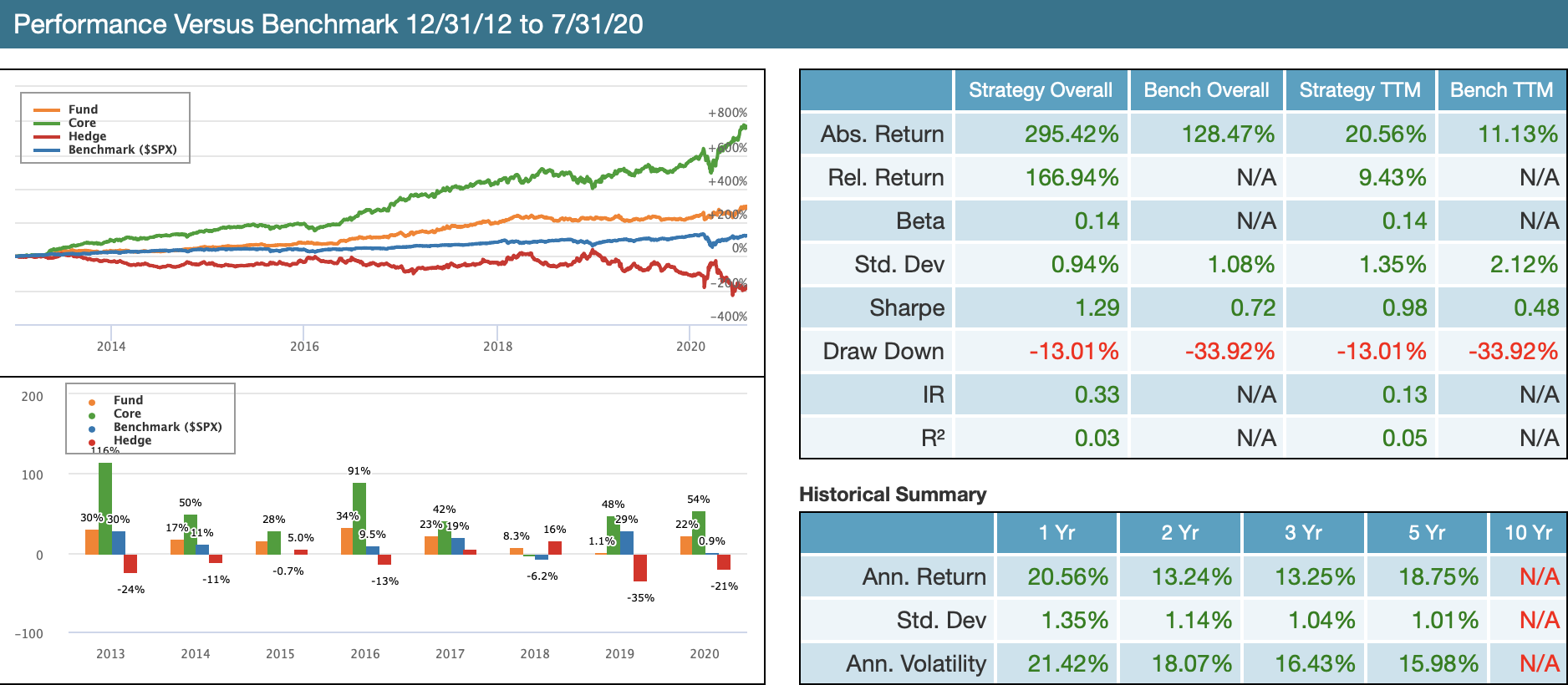

Image 2: Backtest performance of one of the sectors. Technology core holdings with a short only hedge forms a technology centric long/short strategy. Benchmarked against the S&P 500. Performance for 1X leverage net of transaction costs and slippage. Backtest simulation results. Past performance is not indicative of future returns.

- Optimize the allocation of the fund’s net liquidation value (NLV) between the individual sub-strategies aiming to achieve maximum Sharpe ratio.

The optimizer treats each sector-level long/short model as a single synthetic asset on which it optimizes its allocation between the sectors via Markowitz’s mean-variance optimization.

By selecting a subset of the above sector strategies and properly allocating the fund’s cash between them for a target risk, the strategy was able to achieve impressive historical risk-adjusted returns.

The idea is to move cash between holdings in order to exploit sector momentum while maintaining minimum exposure to market surprises. The individual sector portfolios are re-balanced biweekly to minimize turnover while still ensuring responsiveness to current market conditions and that net exposure remains at 0 (equally weighted 50% long and 50% short).

How was each sector/asset portfolio constructed?

We conduct the following for each of the sectors/asset types:

- Using Neuravest’s proprietary portfolio replication technology, we identify the most influential constituents per each sector/asset class.

- Utilizing Neuravest’s portfolio optimization technology, we optimally allocate the portfolio’s cash between the underlying technology for a maximum long-only return.

- We then incorporate Neuravest’s hedging technology to identify short only constituents with specific uncorrelated characteristics to the core holdings. The short-only selection is a subset of a prequalified universe of short candidates filtered in advance using Neuravest’s Event Study technology.

- Neuravest’s order execution engine ensures that all transactions meet liquidity constraint requirements specific to the size of the assets deployed.

How does the portfolio select which sectors/asset types to include and how to allocate between them?

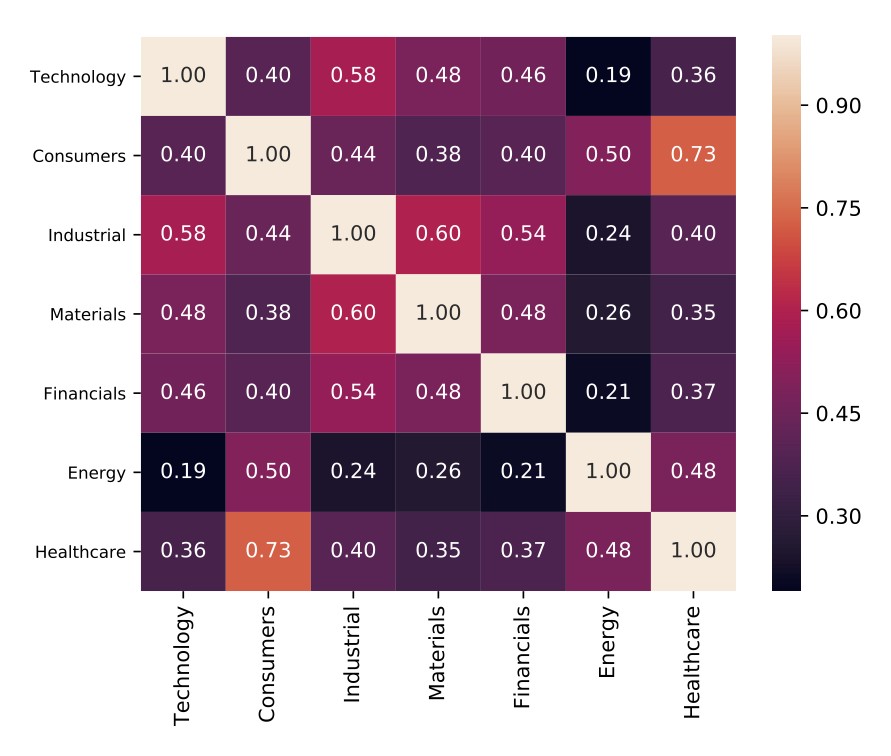

Now that we have seven individual sector long/short portfolios and two additional asset type long/short portfolios, we look to assemble the final portfolio. We perform a mean-variance optimization (based on Markowitz’s Nobel-winning portfolio theory and its approach to portfolio construction using the efficient frontier). We assume each long/short strategy represents a synthetic single security’s historical time series. Subsequently, we create a portfolio of up to nine synthetic securities and use it as input to the mean variance optimizer.

Image 3: Correlation matrix between the seven sectors’ historical performance. These correlations are used as covariance inputs for the MPT optimizer.

Final results and execution guidelines

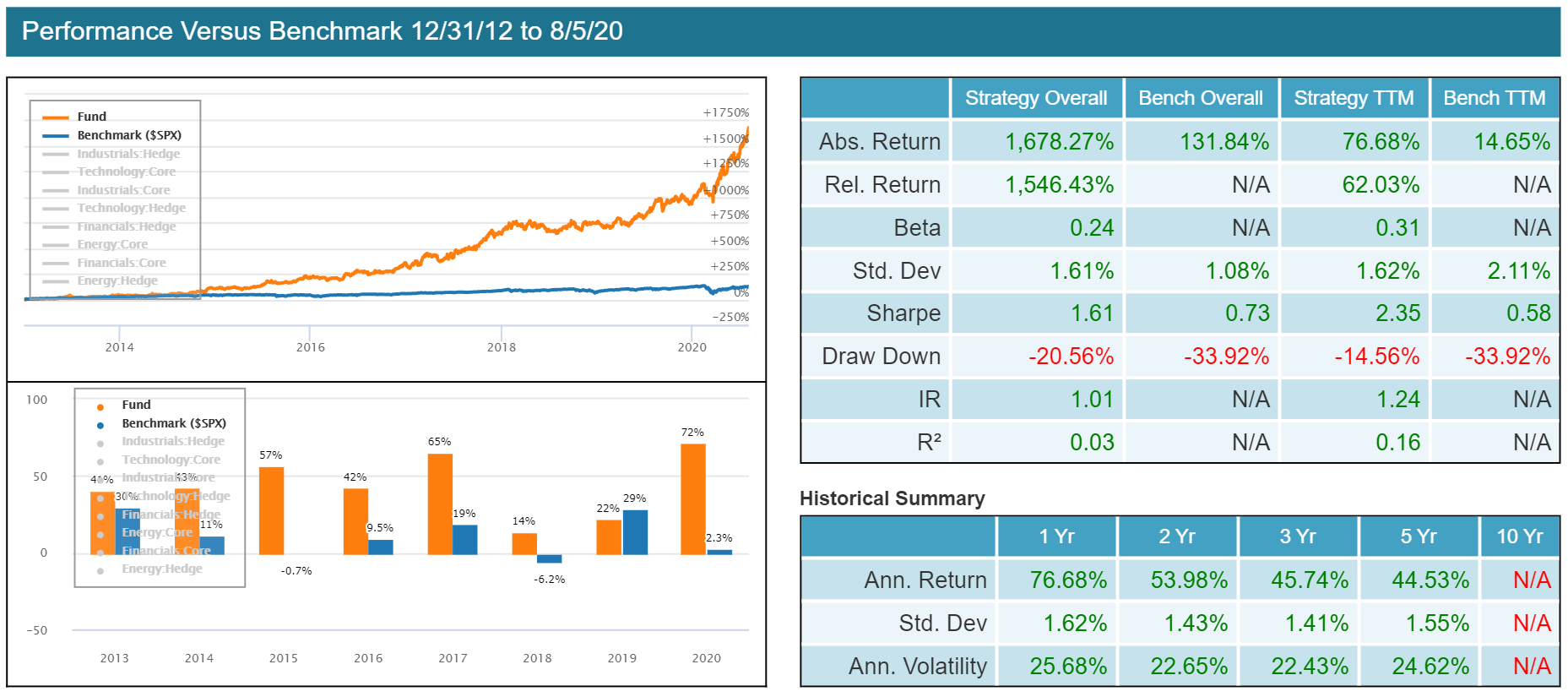

This multi-layered optimization hedging approach, at the individual sector level and between sectors, results in a low volatility historical performance. We can see this low volatility profile manifested by a max drawdown of 7.27% for the strategy, compared to 33.92% for the S&P 500 over the same timeframe (see backtest performance chart in Image 1). As such, we can lever the portfolio 3X, maximizing performance while still preserving lower volatility against the market. In addition, in order to protect the portfolio from unexpected market moves, we applied a sector-level stop loss. This sector stop loss exits both long and short sub-sector constituents simultaneously. This approach is superior to having a stop loss at the individual security level because it enables us to maintain the long/short balance with close to zero net exposure.

Image 4: Backtest performance of sector hedge long/short strategy with 3X leverage against the S&P 500. Performance is net of transaction costs and slippage. Backtest simulation results. Past performance is not indicative of future returns.

If you wish to learn more about the technology employed or about about Crimson Black Capital SP, please feel free to reach out.

Disclaimer: Crimson Black Capital SP is managed by Falcon Investment Management. Falcon Investment Management Ltd, is authorized and regulated by the Financial Conduct Authority (FCA). Registered in England and Wales with registered number 09277206 and FCA registered number FRN 673552. The price and value of the investments referred to in this presentation and the income from such investments may fluctuate, and investors may realize losses on these investments, including a loss of principal. Past performance is not indicative or a guarantee of future performance. The information contained in this presentation and any attachments is for information purposes, and should not be regarded as an offer to sell or a solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be in violation of any local laws. It does not constitute a recommendation or take into account the particular investment objectives, financial conditions, or needs of specific investors.