Erez Katz, CEO and Co-founder of Lucena Research

Using Machine Learning To Hedge Your Portfolio

While the risk of a protracted bear market is low, volatility and risk are back. Investors are quick to react and protect themselves, as evidenced by our trial requests activity.

Every time there is a significant drop in the market we see a correlating influx of inquiries for our QuantDesk® Hedge Finder. Here is how machine learning can be used to hedge your portfolio.

How Does a Pattern Matching Hedge Finder Work?

QuantDesk® is an AI investment research platform powered by big data for investment professionals. An investment strategy can be built, backtested and deployed before capital and resources are risked. The Hedge Finder is a unique approach to reducing volatility for a given portfolio without completely sacrificing its return potential.

Let’s assume you have a portfolio made of ETFs that track the S&P 500. A typical hedging approach will look to protect your holdings, but it can come at a heavy cost by reducing your portfolio’s return potential. In many cases, investors buy protective puts or simply short individual ETFs in order to maintain a cash neutral or beta neutral portfolio.

Read How to Hedge Your Portfolio With Gold

In contrast, the QuantDesk® Hedger constructs a hedge by matching a pattern. Before we showcase how to hedge the S&P, let’s look briefly at portfolio replication technology.

Portfolio Replication

The portfolio replication technology constructs a portfolio (selects constituents and sets their allocations) that tracks a given returns time series.

For example, if I’d like to build a portfolio that tracks the XLE (the energy select sector SPDR ETF), using constituents from the S&P 500, I can ask the portfolio replication engine to identify up to 10 constituents from the S&P that together track XLE. Here is what it looks like on QuantDesk®:

Replicating XLE: There are three overlapping lines in the chart: original, target and replica.

The lines overlap each other almost perfectly, as evidenced by the energy stocks chosen by the replication engine which are among the largest holdings in XLE.

How Does The Hedger Utilize Replication To Construct a Hedge?

If we were to draw an imaginary line that depicts the perfect hedge for SPY, we can ask the portfolio replication engine to replicate that for us. The replication engine will attempt to find a collection of constituents and their allocations that track our hedge. Our hedge time series is nothing more than a mirror image of our original portfolio along its trend line.

The blue line is our original time series and the green line is its mirror image if we were to “flip” it along its trend line.

Putting the Technology to Work

Now let’s hedge the SPY with a collection of ETFs by asking the hedger to find a collection of securities that will serve as a hedge. As you may recall, we are looking for ways to minimize volatility and downdraft exposure on SPY while still protecting its projected trend line.

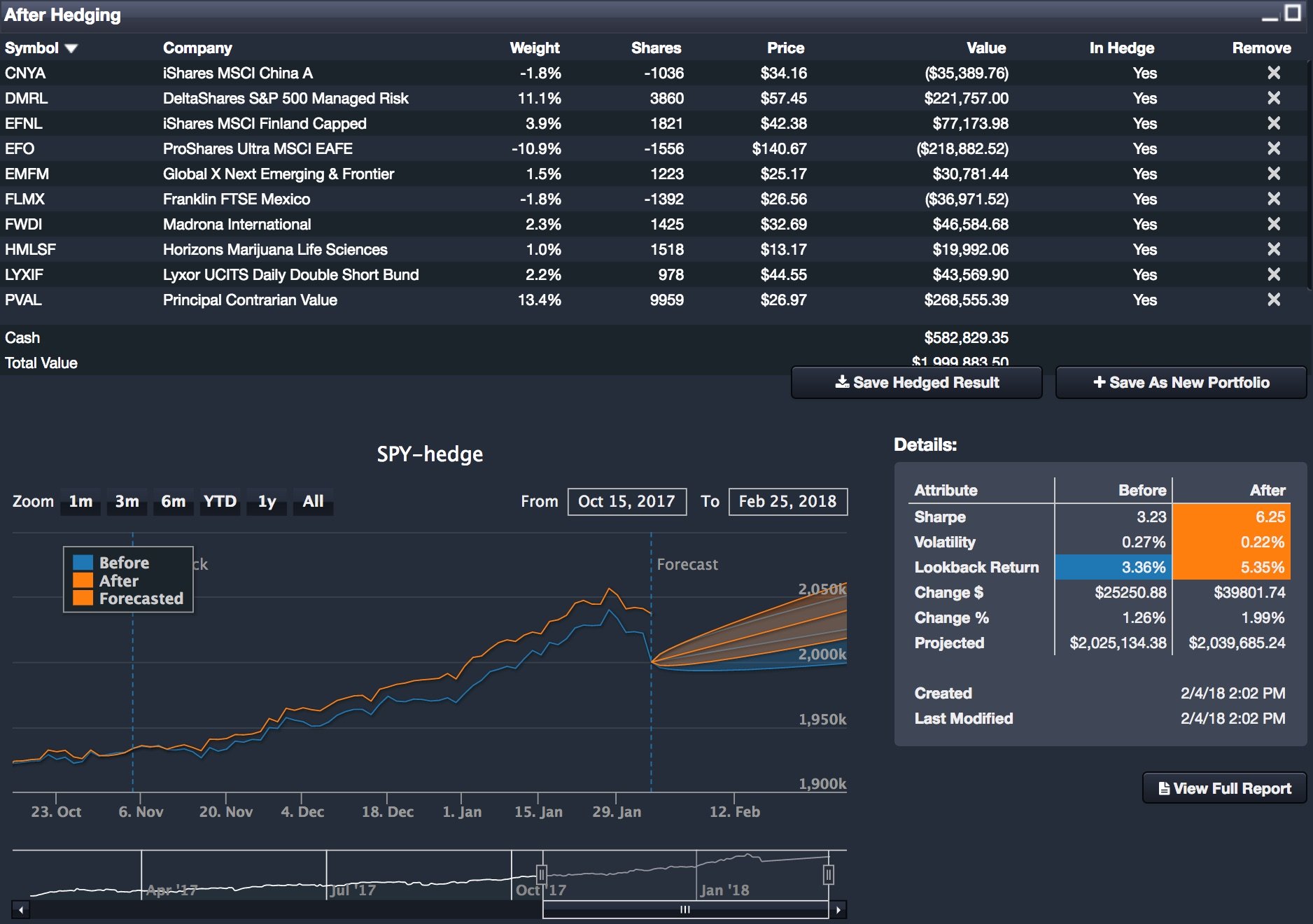

Hedging the SPY. The constituents listed above are based on a $1M hedge allocation for $1M worth of core holding (SPY). Past performance is not indicative of future returns.

The hedged portfolio (marked in orange) suffered some downdraft (see the drop left of the cones). However, the drawdown was much more subdued and manageable. In addition, as you look at the one-month projections, the hedged portfolio (SPY and the recommended hedge positions together) is projecting higher returns, lower volatility and a much higher Sharpe ratio.

At Lucena, we strongly advocate full transparency of our offerings. We love to educate in order to combat the “black box” image that many are quick to label AI platforms. By providing a transparent strategy and execution, results can be shared with your clients in a timely and effective manner.

More Investment Strategies:

The Benefits of a Multi-Strategy Investment Approach

Protect Your Long Only, Bottom Up, Deep Value Fundamental Portfolio