Erez Katz, CEO and Co-founder of Lucena Research

The Benefits Of A Multi-Strategy Investment Approach

Every Market Regime Presents Investment Opportunities

Specific to the heightened volatility and broad market selloffs we’ve been experiencing since October of 2018, several of our custom strategies have actually performed exceptionally well.

Broadly speaking, change in a market regime rarely occurs or lasts overnight. Market sentiment changes more gradually and lasts longer compared to a single thematic strategy or an individual asset.

If we can quantitatively identify a market regime, we can algorithmically deploy the most appropriate strategy set to maximize our fund’s potential returns.

Why A Multi-Strategy Approach for Portfolio Optimization

The concept behind a multi-strategy fund is to combine a wide array of uncorrelated strategies and to enable the fund to profit during any market by identifying which strategy should be overweighted or underweighted in order to advance the fund’s risk adjusted returns.

Here is a deeper dive into constructing a multi-portfolio investment strategy.

Below are two of our multi-strategy model portfolios that have weathered the market volatility rather well. I specifically picked two long-only strategies as short strategies are not always an option. In the current market selloff, long-only strategies are likely to perform well independent of their algorithmic approach.

It’s also worth noting that all of our model portfolios are based on quantitative technology, we never allow a human input override. Our customers, in turn, are encouraged to apply any overlay they deem appropriate and use their own judgement in their final investment decisions. Finally, what we will be presenting are model portfolios that trade perpetually into the future. In other words, these are not backtests.

Model Portfolios:

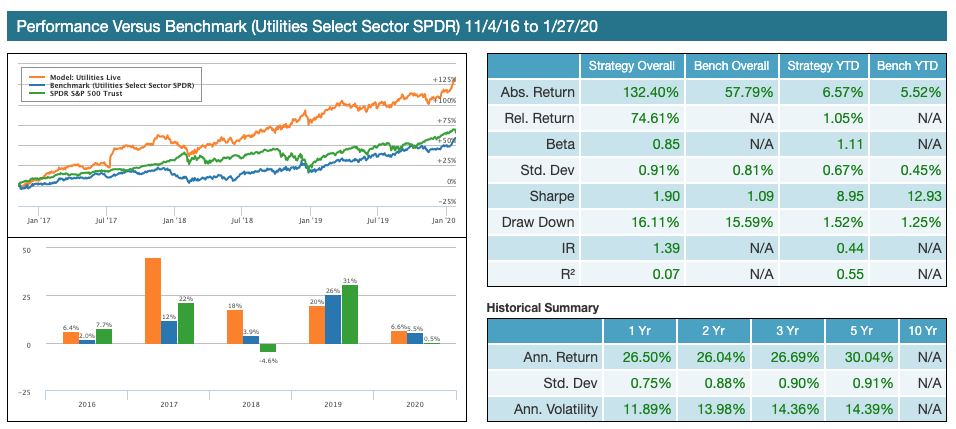

Utilities Live – Returns 132.40% with a Sharpe of 1.90

Utilities stock are considered a safe haven destination that tend to do well during market trepidations. These high dividend stocks present a low-risk alternative to fixed income instruments and are especially attractive in a low interest environment.

The portfolio’s goal is to track the Utilities Sector Select SPDR ETF (XLU) aiming to achieve higher Sharpe ratio through active rebalancing. This portfolio consists of up to ten securities from the Russell 1000 that together behave similarly to XLU.

The securities are identified using Lucena’s portfolio replication technology. In addition, we deploy our machine learning optimization engine (MVO combined with a regression-based forecaster) to optimize the portfolio regularly.

Our aim is to achieve maximum Sharpe or risk adjusted return. In addition, strict trailing stop loss guidelines are activated per security in order to limit the loss in the event that rogue constituents move unexpectedly.

The performance report represents a perpetual paper trading simulation. Two benchmarks are used: XLU (Utilities SPDR ETF) in blue, and SPY (SPDR S&P 500 ETF) in green. Past performance is not indicative of future returns. Link to live report here.

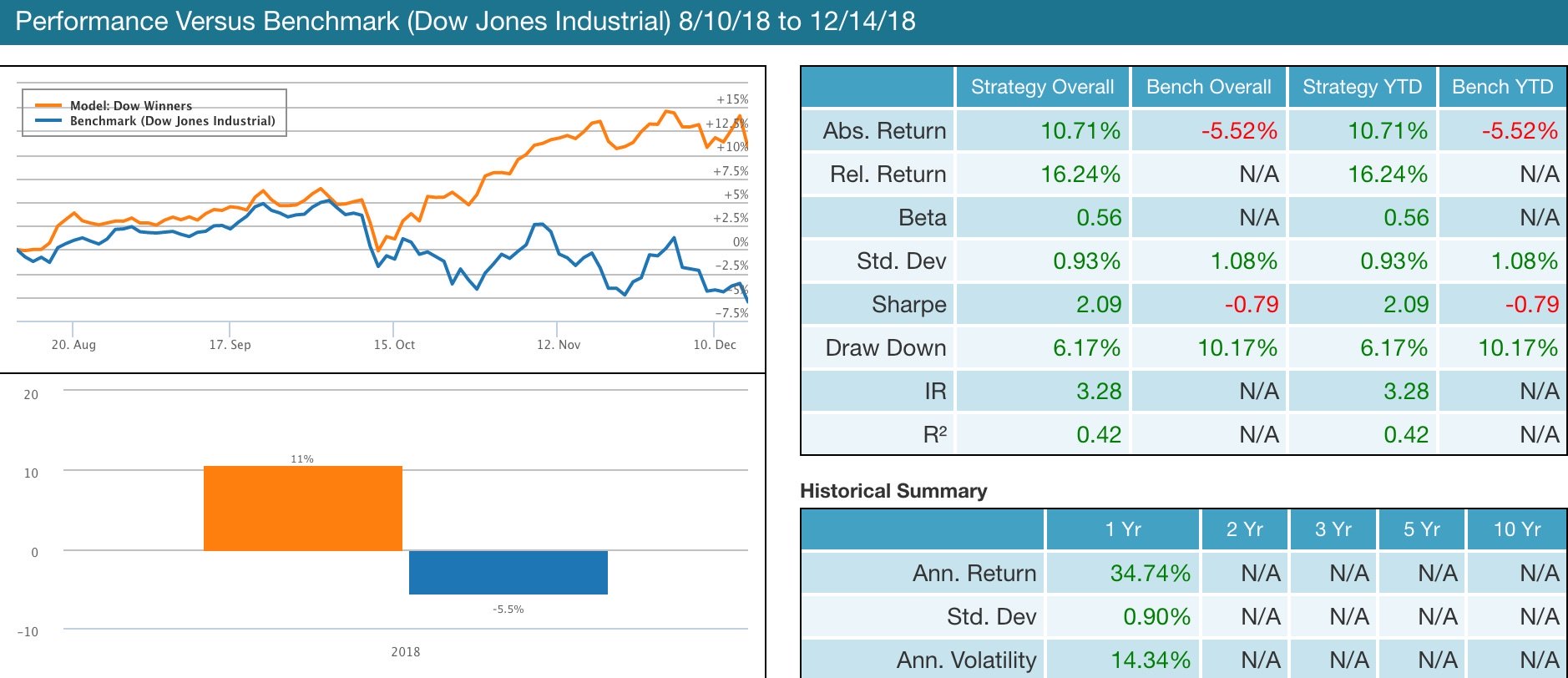

Dow Winners – Since August 10 (approx. 4 months) Returns of 10.71% with a Sharpe of 2.09

Dow Winners is a highly-concentrated stock picking strategy. The idea is to identify highly-liquid securities from the Dow that are set to outperform it during the periods in which they are held. The selection criteria is so specific that at times no constituents are held and the portfolio may be kept in cash until new securities are identified for entry.

The portfolio’s goal is to outperform the Dow Jones Industrials in both total returns and Sharpe ratio through active stock picking. The strategy identifies individual securities from the Dow using Lucena’s event scan technology.

A multi-factor screening is constructed using the Event Study classification technology in order to select the stocks in the Dow that are set to outperform it in the near future (up to three forward looking months).

The factors used for screening are predominantly ranked fundamentals. Ranked fundamentals are different from traditional fundamental factors by which they are designed to evaluate stocks against each other on a normally distributed baseline. The strategy performs the scan daily, however the strategy exhibits low turnover since the selected constituents are held conditionally for as long as they satisfy the scan criteria that selected them originally.

The performance report represents a perpetual paper trading simulation against a benchmark DIA (SPDR Dow Jones Industrial Average ETF) in blue. Past performance is not indicative of future returns.

The Value of Multi-Strategy Investments

The value of a diversified multi-strategy investment has been well documented over the years. Shifting risk to more than one strategy reduces the risk of the overall investment. The value in multi-strategy funds is the flexibility to capitalize on the best strategy for a given market.

Single strategy funds are limited in the scope of their investment opportunities and will likely not consistently perform well. A single fund manager will likely be forced to reduce exposure by shifting into cash or remaining invested to “weather the storm”, both are sub-optimal relevant to a multi-strategy alternative. In contrast, multi-strategy funds can allocate capital away from less attractive strategies to those that offer superior opportunities.

Successful multi-strategy funds have developed “best of breed” investment strategies for a wide array of asset universes and market regimes. Flexibility, capacity, low beta, and high risk-adjusted returns are some of the benefits of multi-strategy funds.

Want to know if our current strategies are still beating the benchmarks? Ask us.