Erez Katz, Lucena Research CEO and Co-founder

During our panel event in NY I referenced how deploying big data in a consumable and actionable format is a critical need for most investment professionals. In order to serve this need, our team has developed three distinct products suitable for various use cases. Namely:

- Smart Data Feeds – A simple and cohesive signal output derived from multi-factor models.

- Model Portfolio – A perpetually simulated paper portfolio based on multi-factor models.

- KPI Forecasting – A pre-earnings forecast of a company’s key performance indicators.

Today, I’d like to briefly discuss KPI Forecasting.

KPI Forecasting:

Projecting a corporation’s KPIs is normally more accurate than projecting a stock price. The reason is KPIs are less susceptible to the inherent noise of the stock market.

Our subscribers receive per symbol reports (similar to the image below) delivered daily throughout the quarter, up to one day prior to earnings date. After earnings release we adjust accordingly, and start fresh the following day forecasting the next quarter.

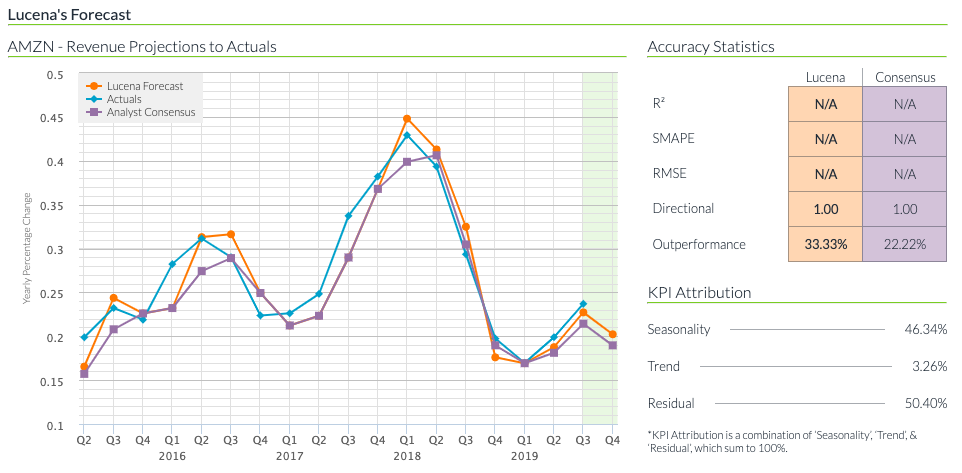

Amazon year over year quarterly growth forecast vs. street consensus vs. actuals. Past performance is not indicative of future success.

For the full report click here. You can find other KPI forecasting examples here for Home Depot and Walmart.

The chart above showcases out-of-sample historical performance, but it also provides foresight into next quarter’s projected revenue growth (highlighted in the green section). In addition, we measure our accuracy against the street consensus and we’ve noticed that we consistently beat it both directionally and in overall accuracy.

These results did not come about by chance. Rather, there is quite a bit that goes into the final product that enables us to avoid the myriad pitfalls and challenges that might befall a novice data scientist.

It starts with qualified data partners who pass our strict data validation process, and continues with feature engineering, machine learning model training, backtest simulation, and perpetual forward simulation.

On Thursday Sept. 26th come meet our data partners, quants, and business development executives to hear straight from the sources how Lucena combines data and science to deliver alpha to our clients.

Questions? Comment below or contact us here.