Authored by: Erez Katz

Many hedge funds that have enjoyed substantial gains betting against the market in March have reversed those gains, and some have even suffered additional losses due to asset class rotation. In particular, some of the more beaten down stocks – cruise lines, airlines, and energy for example – have now come roaring back on the premise that the COVID-19 crisis is subsiding, although fundamentally their dire state has not changed. Truth be told, no single model remains relevant forever. The only way to drive sustainable returns is to have an agile AI infrastructure that can respond algorithmically to changes and exploit opportunities in any market.

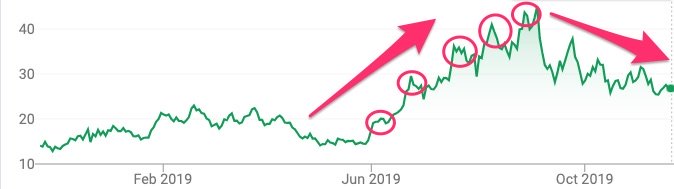

In today’s writeup, I wanted to feature one of our best performing strategies year to date. As of today, Analysts Consensus Retrained (ACR) has enjoyed a year-to-date return of 39.2% – approximately 48% higher than the S&P 500 (its benchmark) for the same period. What’s more important is that it was able to achieve this with significantly reduced volatility and sustained growth.

Image 1: Lucena’s Analysts Consensus Retrained model portfolio performance YTD. Paper Trading Simulation – Past Performance is not indicative of future returns. If you wish to follow the daily performance of this model portfolio in the future, feel free to bookmark this link.

Analysts Consensus Retraining (ACR)

A “long only” portfolio whose goal is to outperform the S&P 500 ($SPX) in total return, while maintaining lower volatility. The ACR portfolio is based on street consensus which averages analysts’ ratings of Russell 1000 stocks, but with a little twist. Rather than simply measuring the mean value of the analysts’ consensus score, the model plays a contrarian role. The model seeks to identify displacement between what the street “thinks” is going to happen and what the model actually predicts. In short, the model identifies high-probability cases in which Street consensus is incorrect (which happens more often that one would think). Feature engineering includes weighing analysts’ consensus based on how accurate they were historically. In addition, the model also considers Lucena’s curated and engineered fundamental & technical factors. The portfolio reassesses its holdings daily and also scans for new securities as it seeks to identify which are optimal.

How does the portfolio adjust to changes in the market?

The factors and their corresponding weights (a score measuring the relative impact a factor has on the outcome) are selected algorithmically using Lucena’s advanced machine learning classification engine. In addition, the factors selected are dynamic as the algorithm continuously re-assesses which are most suitable for the current market. This is done to ensure that the model is responsive to idiosyncratic changes or shifts in investor risk appetite.

Image 2: Lucena’s Analysts Consensus Retrained model portfolio performance YTD. Month over month comparison to benchmark (strategy in orange and benchmark in blue). In addition, please view the risk/return scatter plot (strategy in orange in the desired upper left portion – higher return for lower volatility – vs the benchmark in blue). Paper Trading Simulation – Past Performance is not indicative of future returns. If you wish to follow the daily performance of this model portfolio in the future, feel free to bookmark this link.

Conclusion

The extreme market volatility and asset class rotation have caught many investors by surprise. The “buy and hold” concept that has worked so well in past years has yielded massive losses to ordinary investors. Conversely, sophisticated hedge funds were able to exploit such market displacement and profit handsomely by employing data science and agile, self adjusting, machine learning algorithms. Lucena’s partnership with leading data providers combined with our advanced machine learning capabilities uniquely position us as a technology partner for investment professionals looking to embrace this new reality and regain their competitive edge.

If you are looking to validate your investment approach or just looking for sophisticated investment ideas, feel free to contact us and learn more about Lucena’s model portfolio offerings.

Questions about analysts consensus sentiment utilizing dynamic machine learning training? Drop them below or contact us.