Erez Katz, Lucena Research CEO and Co-founder

Alternative Data Based Long and Short Portfolios

1. Long Only: Earnings date advancement (changing earnings date to be earlier than previously published)

2. Short Only: Earnings date postponement (changing earnings date to be later than previously published)

Lucena’s Model Portfolio

Lucena delivers model portfolios algorithmically powered by big data and AI. The concept behind the model portfolio is as follows:

1. Carry forward the very same execution rules of a backtest into the future where decisions are made and published before market open.

2. Simulate as authentically and realistically as possible in order to provide unbiased assessment of alternative data in real-life scenarios.

3. Help define and validate new investment ideas with empirical evidence.

Model portfolios support rich execution features such as OCO (Order Cancel Order), Stop Loss & Target Gain, allocation guidelines, transaction costs, and slippage.

In addition, a comprehensive performance attribution report is available on demand for real-time assessment.

Wall Street Horizon’s Model Portfolios

Wall Street Horizon’s model portfolios are based on multi-factor models set to identify bullish or bearish signals based on corporate earnings date restatement.

By combining Wall Street Horizon’s corporate event data with advanced fundamental and technical factors created by Lucena, we were able to achieve a high degree of accuracy over multiple market regimes in backtesting and perpetually since the model portfolios were created.

How Does the Model Portfolio Trade?

A multi-factor model is nothing more than a multi-criteria filter or a scan. In essence, we apply machine learning classification to identify which attributes (factors) are most selective of constituents with impending abnormal price action either bullish or bearish.

The model portfolio scans for securities daily and identifies which are most primed for entry. Once positions are identified, the model creates trading orders pre-market based on its allocation restrictions and available cash.

Upon trade execution after market opens and based on live intra-day prices, transactions are created and the positions are then held until either their time elapsed in which they close on MOC (market on close) or an intra-day stop condition is triggered intra-day (stop loss or target gain).

The idea is to provide full transparency by which all trades are determined and execution guidelines are published pre-market. Furthermore, all trades are netted of transactions cost, slippage and short borrowing cost.

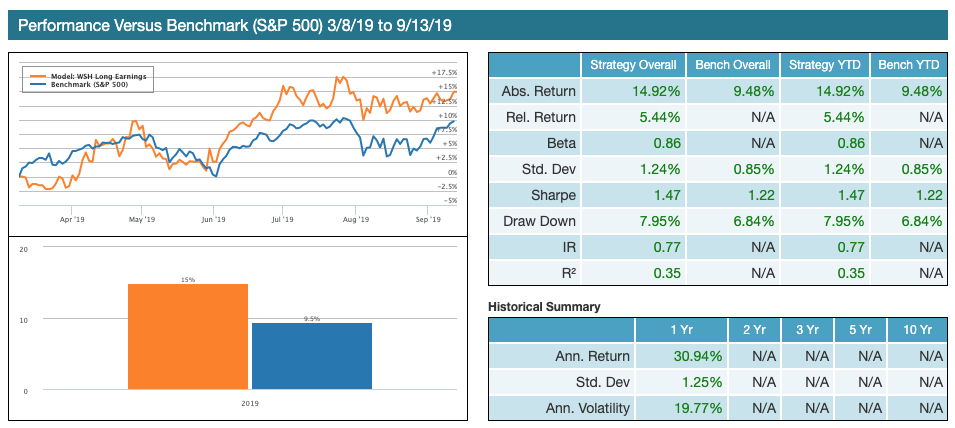

Wall Street Horizon Earnings Restatement Long Only Strategy

Target goals: Market relative outperformance, low volatility, and high Sharpe.

Wall Street Horizon Long is a paper traded simulation of a multi-factor model set to identify buy signals based on Wall Street Horizon’s earnings date restatement data.

More specifically, the portfolio is set to identify optimal conditions for entry when a company restates its earnings release date to be earlier than it was originally set. The portfolio focuses its selection scan on constituents in the S&P 500. The portfolio selects its assets using Lucena’s event scan technology which identifies the equities most likely to outperform the S&P 500 within a predetermined timeframe.

The scan runs daily and once constituents are identified for entry, the available cash is equally allocated between all the newly entered constituents. Dynamic stop loss and target gains are assessed as OCO (order cancel order) on all positions. The portfolio can stay in cash if no constituents are identified.

View a live update of the strategy here.

Wall Street Horizon’s Long Earnings Model Portfolio performance. Paper traded simulation. Past performance is not indicative of future returns.

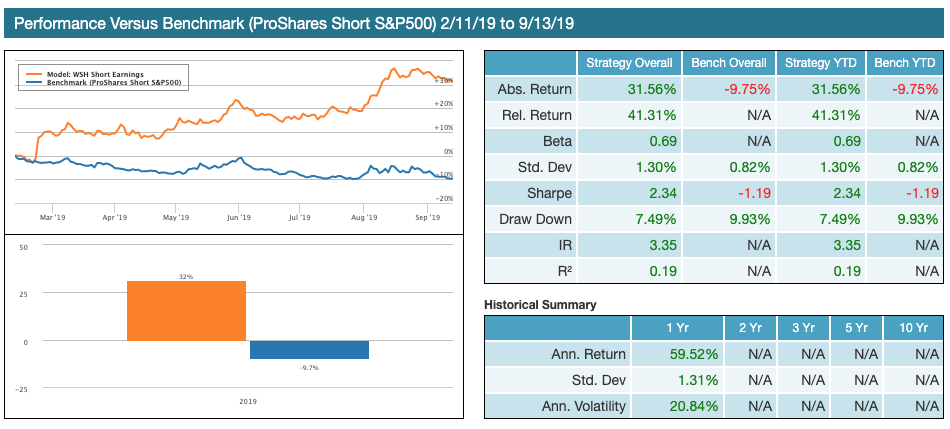

Wall Street Horizon Earnings Restatement Short Only Strategy

Wall Street Horizon Short, is a model portfolio set to identify short signals based on Wall Street Horizon earnings date postponement.

More specifically the model is to identify optimal conditions for entry when a company shifts its earnings release date to be later than it was originally set. The model portfolio scans securities from the S&P 500 universe.

The portfolio selects its assets using Lucena’s event scan technology which identifies the equities most likely to underperform the S&P 500 within a predetermined timeframe.

The scan is executed daily before market opens and when constituents are identified for entry, orders are formed pre market set to execute after market open based on real-time prices.

Positions are equally weighted as short positions with the assumption that all positions are “shortable”. There is a strict stop loss condition on every entered position. The portfolio can stay in cash if no constituents are identified.

View a live update of the strategy here.