A recent article on Bloomberg.com indicated a surprisingly disappointing performance of some of the most advanced and popular quantitative hedge funds, namely, Renaissance and Two Sigma. The article states that through the end of October 2020, RenTech accumulated staggering losses on its long-biased fund, market neutral portfolio, and global equity funds, which were down 20%, 27%, and 25%, respectively. Two Sigma also amassed significant losses. Specifically through the end of October, its risk-premia strategy was down 11.5% for the year, while its absolute return macro fund slumped 23%. RenTech and Two Sigma are not alone. There are plenty of other sophisticated funds that have endured the same pain of a market regime no longer predictive by their traditional AI models. Indeed, in a market that breaks new highs in record numbers, how could it be that investment powerhouses missed so handsomely?

If you wonder, is it game over for RenTech and Two Sigma specifically or for quantitative investment as a whole? The answer is emphatically no!

By definition, learning is the process of acquiring knowledge through experience, self- study, or being taught. This applies to both humans and machines and indeed it is not unprecedented for AI models to face a market they have not seen before (i.e., a market behaving “irrationally” due to a global pandemic). I fully expect that the capable quants of both firms will be able to quickly adjust and deploy new models that will ultimately return to generating the expected annual returns their customers have been accustomed to.

Over the course of the year, we’ve advocated and published articles about the necessity of AI models to be dynamic and self-adjusting. In today’s article, I’d like to take the notion of dynamic adjustment one step further and advocate another technique we’ve adopted at Lucena that is geared to generating returns (not just beat the benchmark) in any market regime.

Top-Down and Bottom-Up Approach to AI Investment

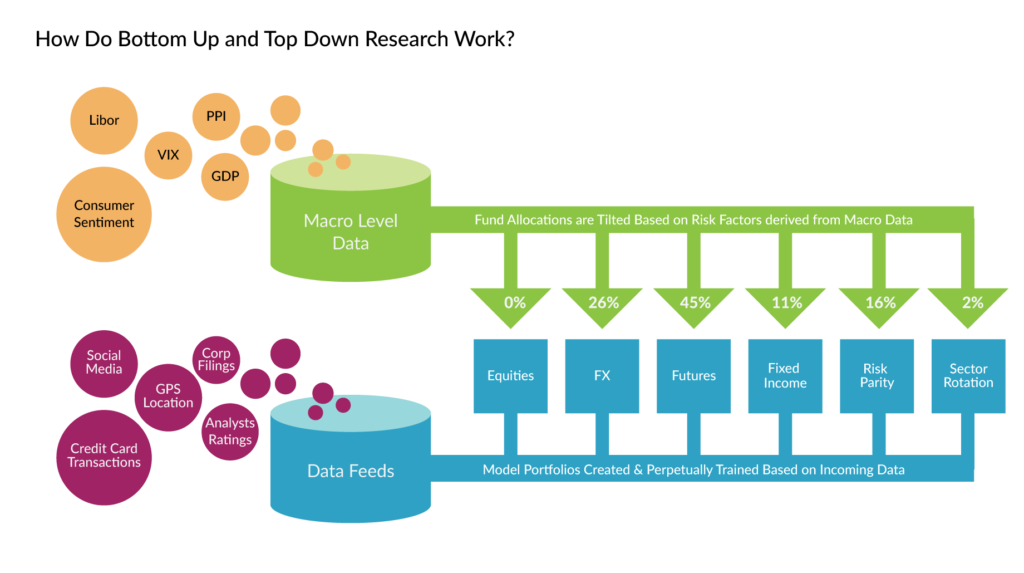

In a top-down and bottom-up investments, hedge funds seek to deploy multiple uncorrelated strategies in order to overcome the inevitable drawdown periods that each strategy is destined to face. No matter how good the model is, or if it is a true market neutral, there will always be a period in which it is going to underperform. It may be a cliche, but it is true that no portfolio goes up in a straight line. Yet the expectations remain that in the long run, each underlying portfolio will significantly outperform their respective benchmarks, but as investment professionals we target absolute return (not just beating the benchmark). The approach depicted in this article allows the incorporation of multiple uncorrelated strategies into a single fund by executing high conviction trades through agreements between two opposing machine learning approaches: Top-down and bottom-up.

Image 1:Bottom-up and top-down approach to a multi-strat fund.

As you can see from the image above, the idea is to leverage two different sets of data and machine learning techniques in order to gain a consensus between them.

In the bottom-up approach, we employ a stock picker’s paradigm (or really any underlying asset such as futures, foreign exchange pairs, etc.) in which we score buy/ sell conviction sentiment at the individual asset level. We then aggregate all the scores in order to get a normalized bottom-up total sentiment per strategy. For example, if we were to score a strategy that picks positions within the S&P 500, we will score each stock in the S&P individually and will aggregate the scores to get a single confidence measure for the entire universe.

The top-down approach will take a risk model optimization approach (Markowitz’s efficient market theory’s mean variance optimization, MVO) by which we evaluate how to allocate funds between the strategies as if they were individual assets (synthetic assets). We use machine learning models based on macro data trends (such as CPI, PPI, VIX, Libor, unemployment etc.) in order to forecast the strategies future returns (as if each strategy is represented by a synthetic asset in a portfolio) and future volatility. From the macro level optimization, each strategy will receive a top-down score (based on its allocation percentage).

Ultimately, the fund will seek to achieve consensus between the bottom-up and top-down sentiments in order to decide which strategies will receive the lion’s share of the underlying AUM (assets under management).

Conclusion

Recent disappointing performance by popular quant funds necessitated a fundamental shift in how machine learning algorithms are deployed for investment. A bottom-up, top-down approach utilizes an array of winning strategies by which allocation dynamically shifts based on macro market trends. At the heart of this multi-strat fund approach, we seek to achieve high conviction decisions from two opposing directions: a bottom-up stock picker approach, and a top-down macro level allocation.

Successful deployment is truly dependent on how quickly the fund can adjust to changes in market risk and shift its allocations between its strategies.

Image 2: A collection of uncorrelated strategies. As can be seen in the image, at various times some strategies outperform while others lag.

Image 3: A smart multi-factor risk model optimization enables early detection of changes in market risk, and the constituents universe in focus. As allocations change between strategies the fund achieves consistent low-vol performance over different market regimes.

At Lucena, we pride ourselves on building a wide array of winning strategies. Most of them not only beat their benchmark but have enjoyed consistent healthy returns.

All our model portfolios trade strictly algorithmically (human discretion free) and are able to connect in real-time to live brokerages.

If you’d like to learn more about our thematic strategies or if you have a vision that you’d like to implement custom to your needs, please feel free to reach out. We are happy to showcase what we’ve done and are ready to work hard in order to earn your trust.

Erez Katz

Co-Founder & CEO

erez@lucenaresearch.com