Erez Katz, CEO and Co-founder, Lucena Research

In 2017 Larry Fink, CEO of BlackRock, made a bold statement that rattled the Financial industry.

Fink announced his firm’s decision to invest heavily in AI driven investment strategies. His statement propelled some uncertainty and doubt for smaller financial firms already competing with the $5 trillion AUM big boys’ teams of PhD quants.

Now factor in the addition of stock-picking-super-robots and the industry finds itself in a technology arms race. Let’s get a few things straight.

Ai Fact Vs. Fiction

As CNBC’s Josh Brown [@reformedbroker] said, the controversy around AI-assisted vs. human investing is not about active vs. passive investing but rather systematic vs. faith-based investing.

Basically, it’s humans with better calculators. BlackRock is offering customers lower-cost quantitative stock funds that rely on data and computer systems to make predictions, an investment option previously available only to large institutional investors.

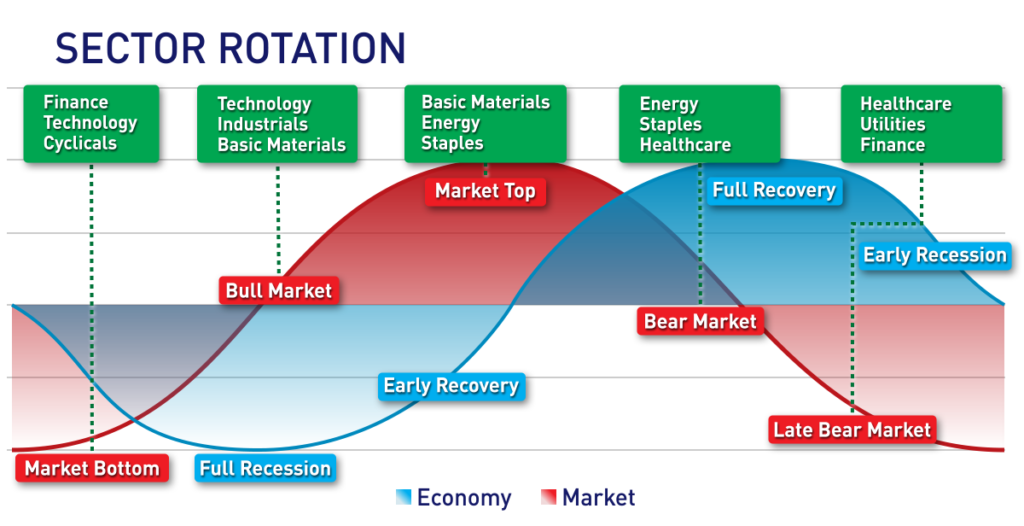

Even sophisticated active managers wait for the very moment of capitulation to enter their positions, since it represents the optimal entry point for profit. The human emotional element is truly what makes markets less efficient.

How Machine Learning Bridges the Gap

The good news is that with machine learning and data mining we can quantify the statistical state of an investors’ mood as it relates to a specific stock, sector, or the overall market.

So here’s why smaller competitors should heed Yoda’s warning that “fear is the path to the dark side.” The new capabilities BlackRock is utilizing will ultimately be democratized for the entire financial industry.

In order to stay competitive, small to midsize firms need to also make the same commitment to invest in AI and machine learning platforms.

Dr. Tucker Balch and I founded Lucena Research to bring an AI platform to investment professionals that levels the playing field. Small to midsize financial firms can access investment strategies powered by machine learning to better compete with the BlackRock’s of the world.

Here’s how Machine Learning Can Impact Your Firm:

By utilizing a machine learning platform, you can generate Alpha, minimize risk via portfolio optimizations and construct new portfolios by combining predictive data with machine learning analytics.

Other than in the high-frequency world, Quantitative analysis was never meant to completely remove the human intuition elements. There have been many studies that have documented long-term historical phenomena in securities markets that contradict the efficient market hypothesis and cannot be captured in models based on perfect investor rationale.

To truly make an investment decision free of emotion, one needs to build trust through empirical evidence. Initially in simulation and followed by small capital deployment that gradually grows over time.

In order to continue growth and success, firms need to utilize a scientific overlay approach in order to keep emotion vulnerability in check and to stay competitive in an ever evolving Financial Market.

Interested in taking our platform for a trial run?