Trends in Alternative Data

Why Alternative Data Changes Everything for Asset Management

By Eric Davidson | July 27, 2021 |

Hi friends—thanks for visiting 👋 🔥,

It is easier to disrupt things that are ripe for disruption—and the Asset Management Industry, by many measures, is vulnerable. It’s a bitter lesson for active managers, especially those who charge high fees and routinely fail to beat their benchmark.

According to S&P, over the 10 years ending December 31, 2019, 89% of domestic equity funds and 65% of institutional separate accounts underperformed their benchmarks, net-of-fees. 2020 is a similar story, for the 11th consecutive one-year period, the majority (60%) of Large-cap funds underperformed the S&P 500, although mid and small-cap funds did somewhat better.

We have all seen the chart. Passive fund flows take increasing market share—at the expense of active managers. Active Management = Struggle.

What can help? Specialized technology and new predictive data sources. Forward-thinking managers integrating these solutions are among the early adopters.

We will be exploring these themes in today’s article and in a series of long-form articles published to the Neuravest “Insights” Blog in the coming weeks and months.

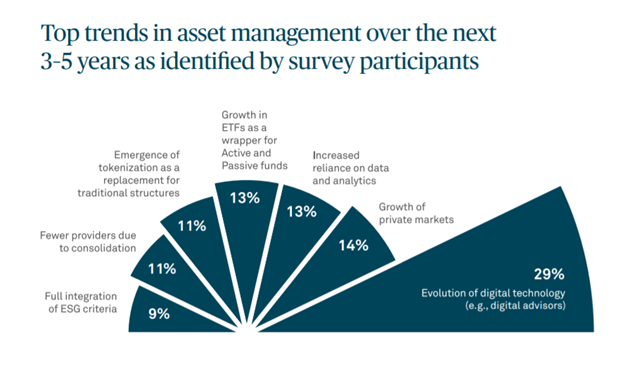

BNY Mellon conducted an in-depth study of trends and concerns in the asset management space with 200 asset managers from around the world during the third quarter of 2020.

The importance of data and technology underpin all of the answers from these institutions—with the “evolution of digital technology” and “increased reliance on data and analytics” near the top of the list.

(Image Source: BNY Mellon)

A wave of recent acquisitions is designed to address these asset management trends and the consequences promise to reshape the industry.

- Franklin Templeton acquired AdvisorEngine in May 2020, which provides wealth management technology to 1,200 advisory groups.

- Folio, a boutique wealth management company focused on Environmental, Social, and Governmental (ESG) investment strategies, was acquired by Goldman Sachs.

- JPMorgan Chase is investing in Environmental and Social investments, as well as Direct Investing, through its acquisition of OpenInvest.

- JP Morgan acquired 55ip, which helps to create tax-efficient investment portfolios for accredited investors.

- BlackRock Inc. acquired Aperio, a creator of customized index strategies, a strategic move that allows the firm to tweak broad indexes for tax and other personal reasons.

- Eaton Vance Corp., which specializes in custom index strategies with its Parametric unit, was purchased by Morgan Stanley.

- Vanguard just bought JustInvest – which is (notably) Vanguard’s first purchase in 45 years.

These acquisitions reflect one of the fastest growing trends in wealth management—Custom and Direct Indexing. While not a new idea, advances in technology and lowered commissions are enabling new possibilities. In this booming niche, fee pressures are insulated and pricing power remains. With customized portfolios, high net worth and institutional investors receive the benefits of tax-loss harvesting and something different for each investor—unique, personalized and thematic portfolios not available in a fund or ETF.

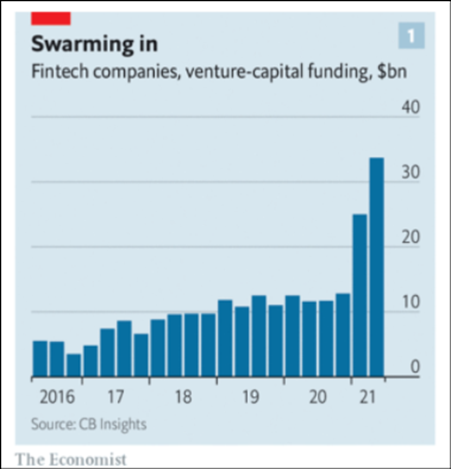

In addition, according to CB Insights, Q2 2021 was not only a big quarter for fintech funding as a whole (which includes a variety of financial applications outside of the asset management industry), it was the largest on record. Software eats the (financial) world.

How does Alternative Data fit into this picture?

While tax-loss harvesting is one of the primary drivers of this acquisition spree, the ability to sell factor portfolios and customize offerings is also a primary driver—which brings new and alternative data sources squarely into the picture.

The number of alternative datasets coming to market is staggering. The Cambrian explosion is a useful metaphor. Many of these datasets will die off. Some have (and many more will) become invaluable to investment managers. Data born of social media, consumer financial applications, mobile and connected devices is growing exponentially. According to IBM, 90% of the data in circulation now is alternative data. It is an economic force with the potential to reshape how portfolios are constructed and managed—and as a consequence, reshape the entire asset management landscape.

Alternative data is not a new trend—but it’s undergoing a step-change in adoption rates across the asset management industry. The pioneers working with non-market generated data in recent decades were the finest financial engineering minds, towering figures who built large, enduring organizations. Yet these firms were few in number. That is changing.

According to Research and Markets, the Global Alternative Data Market size is expected to reach $11.1 billion by 2026, rising at a market growth of 44% CAGR during the forecast period.

The “why” case for alternative data is straight-forward.

(Image Source: Techcrunch)

- It offers funds a competitive edge by identifying market-moving trends intra-quarter, versus relying solely on traditional 10Qs, 10Ks, and other company filings.

- It helps mitigate risks by identifying factors that could hinder a company’s share price—such as supply chain vulnerability.

- It gives a very comprehensive, yet granular, view on human behavior and consumer sentiment.

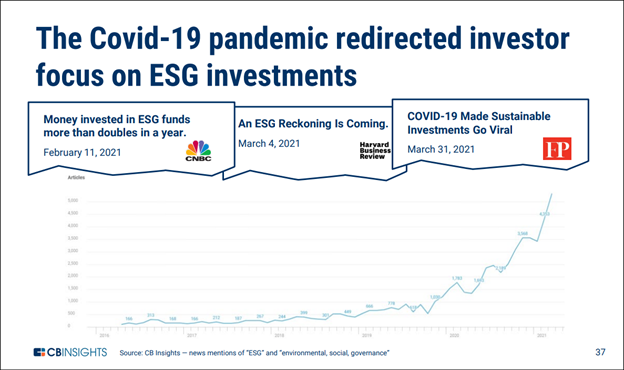

The Socially Responsible movement provides a timely example. Asset Managers who built ahead of the curve with Environmental, Social, Governance (ESG) products caught a wave of inflows in recent years. Differentiating an ESG fund now and in the future will increasingly require specialized data as the central building block.

In a similar way, non-traditional and specialized data sources are playing an increasing role in timely thematic portfolios constructed based on recent developments in the economy—such as the work from home theme and the increasing shift to online shopping.

Alternative data REALLY came into its own during the global pandemic—as corporate executives at publicly-traded firms struggled to provide company guidance amid the uncertainty. During this period, alternative data continued to provide real-time and granular insights based on actual “ground truth” consumer behavior, while insights from traditional data lagged.

The “how” is where Technology and Data intersect. Developing a technology and solutions stack capable of ingesting, validating and blending multiple data sources is a real technological achievement. Moreover, the individuals who develop and maintain the infrastructure must also possess a deep understanding of statistics and computer science. Buy-side market expertise also brings invaluable perspective to the equation. Together, this combination results in a probability that favors differentiated investment performance over time—a formula to bend portfolio performance upward relative to competing funds and passive investments.

The counterargument to all of this bullishness about alternative data is that it is often noisy, expensive, and difficult to work with. Much of this is true, but the depth and breadth of features that can be found solely within these information sources suggests that firms who persevere and overcome the technological and cultural barriers necessary to work with alternative data will find the effort worthwhile.

Conclusion

Let’s take a moment to reflect—it is a time of great change in the asset management space. Because of innovative technologies and an explosion in new data sources, we have the potential for a virtuous cycle in investment research and portfolio management—where advances in machine learning and a growing army of accomplished data scientists are able to unlock fresh insights from an increasing number of data sources—an alternative data flywheel.

Traditional data sources like quarterly earnings reports, company filings and market generated pricing information are still foundational – but are less and less a source of competitive advantage. Newer, real-time and more granular datasets provide intra-quarter insights that hold the promise for an information advantage.

To whom do the benefits of advances in asset management technology and an explosion in new data sources flow? A new breed of Asset Manager—those who understand that the game has changed. This is the new physics of business for the asset management industry—and ignoring it is like ignoring gravity.

Thanks for stopping by 👊.

Eric

If you’d like to get in touch, contact me at: eric.davidson@neuravest.net

This is the first in a series of articles where Neuravest will explore themes directly impacting asset management and alternative data. Throughout this series, we will offer insights and strategies you can use to succeed in a data-driven world.