Consumer Transactions are "ground truth" data that reflect real consumer behavior

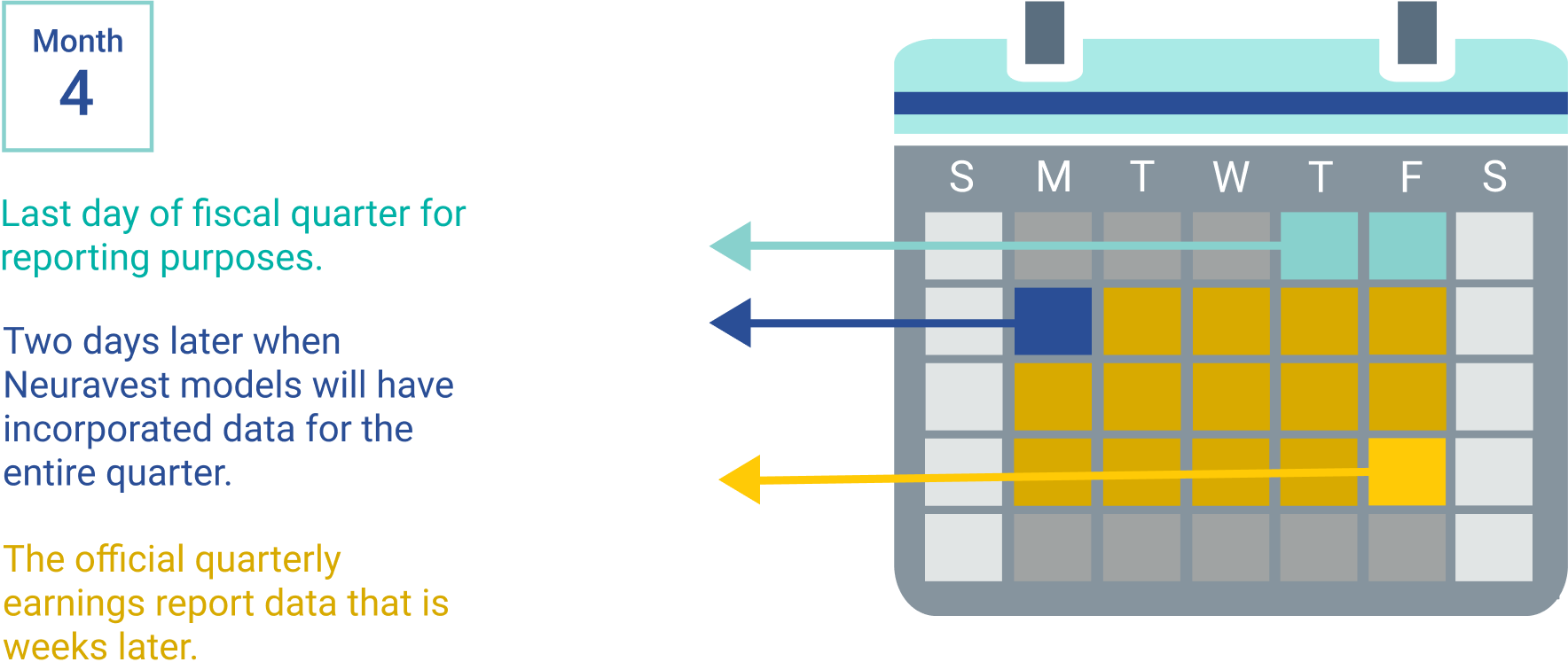

Consumer Transaction Data can provide broad insight into consumer spending patterns at the company, sector and macro level. The data is updated more frequently than official company data releases-offering data-savvy portfolio managers a potential information advantage.