How is ESG Impacting the Pulse of the Market?

Why a revolution has become an evolution.

By Kathleen O’Daly | August 10, 2021 |

Hello long-time followers of our predecessor firm, Lucena Research and welcome new followers to our Neuravest Community Blog! It’s so good to have you!

There are a lot of conversations around ESG these days. And, while it’s certainly not a new topic, it has become the topic du jour for 2021. Cue The Beatles refrain from their song “Revolution 1”, written by John Lennon from their 1968 album 🎶 :

“You say you want a revolution

Well, you know

We all want to change the world

You tell me that it’s evolution

Well, you know

We all want to change the world”

What Exactly is ESG?

For those of you who may have been completely entranced for the last year and a half by your Netflix subscription 😵💫, a quick refresher – ESG represents environmental, social, and governance (ESG) issues in the marketplace. Most conversations these days use ESG interchangeably with the phrase “impact investing”.

According to MSCI.com, ESG investing actually began in the 1960s with investors excluding stocks or entire industries from their portfolios based on business activities such as tobacco production or involvement in the South African apartheid regime.

Today, ESG ratings seek to provide an assessment of the long-term resilience of companies to ESG issues through an industry-specific evaluation of key ESG risks and opportunities. This may quicken the pulse of some business leaders that are not yet ready for the challenge.

(Image Source: FTSE Russell)

What are the benefits of ESG ratings for business?

A high rating is great for brand image and can help companies attract investments and lower the cost of financing.

What are the existing ESG rating systems on the market?

Each rating agency has its own ESG rating system. For example, there are some that are risk-based while others are performance-based. Currently, the most well-known ESG rating agencies in the world include MSCI, RobecoSAM (acquired by Standard & Poor's in 2020), CDP Global Environmental Information Research Center, and FTSE Russell.

What is the ESG rating methodology?

Why Has Investing with a Purpose Become Top of Mind?

On March 10, 2021, the European Union’s (EU’s) Sustainable Finance Disclosure Regulation (SFDR) came into effect. This was definitely a contributing factor to the spotlight on ESG.

So, what is the SFDR?

Essentially, it is a directive that falls under the European Union’s/United Nations’ 2030 Agenda for Sustainable Development. SFDR applies to financial-market participants like asset managers, banks, insurance companies, pension funds, venture-capital funds, credit institutions offering portfolio management or financial advice, which must publish on their websites information about their policies on the integration of sustainability risks in their investment decision‐making processes. Its goal is to contribute about €1 trillion into green investments over the next decade.

Investing with a purpose has become increasingly in the public consciousness due to recent stories tying natural disasters to climate change. By way of example, the Wall Street Journal highlighted a flooding event in Berlin that left over 170 people dead and the cause was attributed to changing environmental factors.

What does the fund flow into ESG look like?

According to Morningstar, through year-end 2020, sustainable fund flows surged past $150 billion USD:

Additionally, the issuance of social bonds soared in 2020, with many focused on mitigating the negative impacts of the COVID-19 pandemic.

USD Value of Social, Sustainability and Green Bond Issuances 2015-2020

However, global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management according to Bloomberg.com.

According to internationalbanker.com, by the end of this year, funds will have to decide to classify themselves as either being fully focused on sustainable objectives; fully or partly focused on environmental, social issues or sustainability issues; or not at all focused on sustainability.

How can companies best prepare for investors’ current demands?

According to PwC’s Consumer Intelligence Series published June 2, 2021, both employees and consumers are making their voices heard and demand that businesses truly invest in sustainability and not simply comply with regulations.

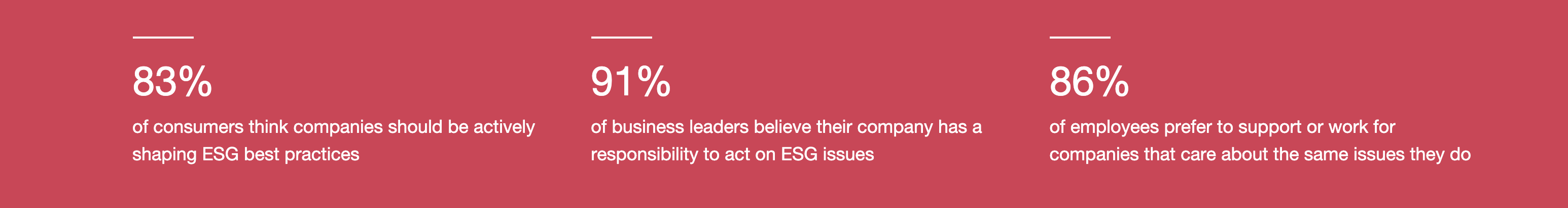

As evidenced by the infographic below, ESG commitments are driving consumer purchases and employee engagement.

Continuing with PwC’s “2021 Consumer Intelligence Series survey on ESG”, the company polled consumers, employees and executives in March and April 2021 and found the following:

Source: PWC.com; 2021 Consumer Intelligence Series survey on ESG.

What do leading institutions have to say about the ESG evolution?

The COVID-19 pandemic has placed greater ESG expectations on corporations globally.

According to the World Economic Forum, at the 2020 Annual Meeting in Davos, 120 of the world’s largest companies supported efforts to develop a core set of common metrics for their investors. Measuring Stakeholder Capitalism, the new set of metrics from the World Economic Forum’s (WEF) International Business Council, can be used by companies to align their mainstream reporting on performance against environmental, social and governance (ESG) indicators and track their contributions towards the SDGs on a consistent basis.

Some of the key measures are anti-corruption, carbon footprint, climate risk oversight, equal pay, diversity and inclusion, renewable energy, and stakeholder engagement. More importantly, they can apply to any sector, making them relatively easy to adopt.

Here are some additional thoughts from America’s top financial institutions:

- JPMorgan

“Clients are increasingly focused on understanding the environmental, social, and governance impact of their portfolios and using that information to make investment decisions that better align with their goals,” Mary Callahan Erdoes, CEO of JPMorgan’s asset and wealth management division, said in a statement.

Moreover, JPMorgan has gone so far as to buy an ESG investing platform, OpenInvest. - Bank of America

“Investing in environmental, social and governance issues should not be a burden. It should be core to the business model”, said Brian Moynihan, CEO of Bank of America Corp. - UBS

CEO, Ralph Hamers in a conversation at the CNBC Global Summit stated “if you look at what our clients truly want, they want to invest with impact.” - BlackRock

Larry Fink, Chairman and CEO of BlackRock, the world’s largest asset manager, recently published his annual letters to CEOs and clients, providing its perspective on ESG questions. The letters highlight the following: “81 percent of a globally-representative selection of sustainable indexes outperformed their parent benchmarks.” He goes on to note that within industries, “companies with better ESG profiles are performing better than their peers, enjoying a ‘sustainability premium.’”

Where will ESG investing take us?

ESG risks and opportunities vary by industry and geography. Where will such investing take us in the future?

Institutional investors are becoming more sophisticated in the way they manage their investments; they are becoming more open to adopting tools like artificial intelligence, machine learning and algorithmic trading which can help them better manage investment risk and potentially increase their alpha. This quest for tools which enable better investment decisions is leading to escalating demand for alternative data sources in combination with fundamental analyses.

Forward-thinking asset managers are already integrating alternative ESG data into their investment decision-making process and they are quickly discovering the value add it provides.

In closing, the ESG revolution that started many decades ago is now going through an evolution. And it’s gaining momentum for the foreseeable future. The pulse in the market is palpable. In keeping with the oldies but goodies theme when we began this conversation, Sonny & Cher’s 1967 refrain echoes… “and the beat goes on, yes, the beat goes on…”

Thanks for checking in!

Cheers,

Kathleen

If you’d like to get in touch, contact me at: kathleen.odaly@neuravest.net