Benefits of Consumer Transaction Data

Consumer transaction data is a form of alternative data that is considered to be “ground truth” data because it is generated by direct observation and measurement as opposed to information provided by inference. Consumer transaction data is strongly correlated to publicly reported revenues. This unique ground truth data can be combined with traditional data generated by publicly traded companies to construct portfolios that have the potential to outperform.

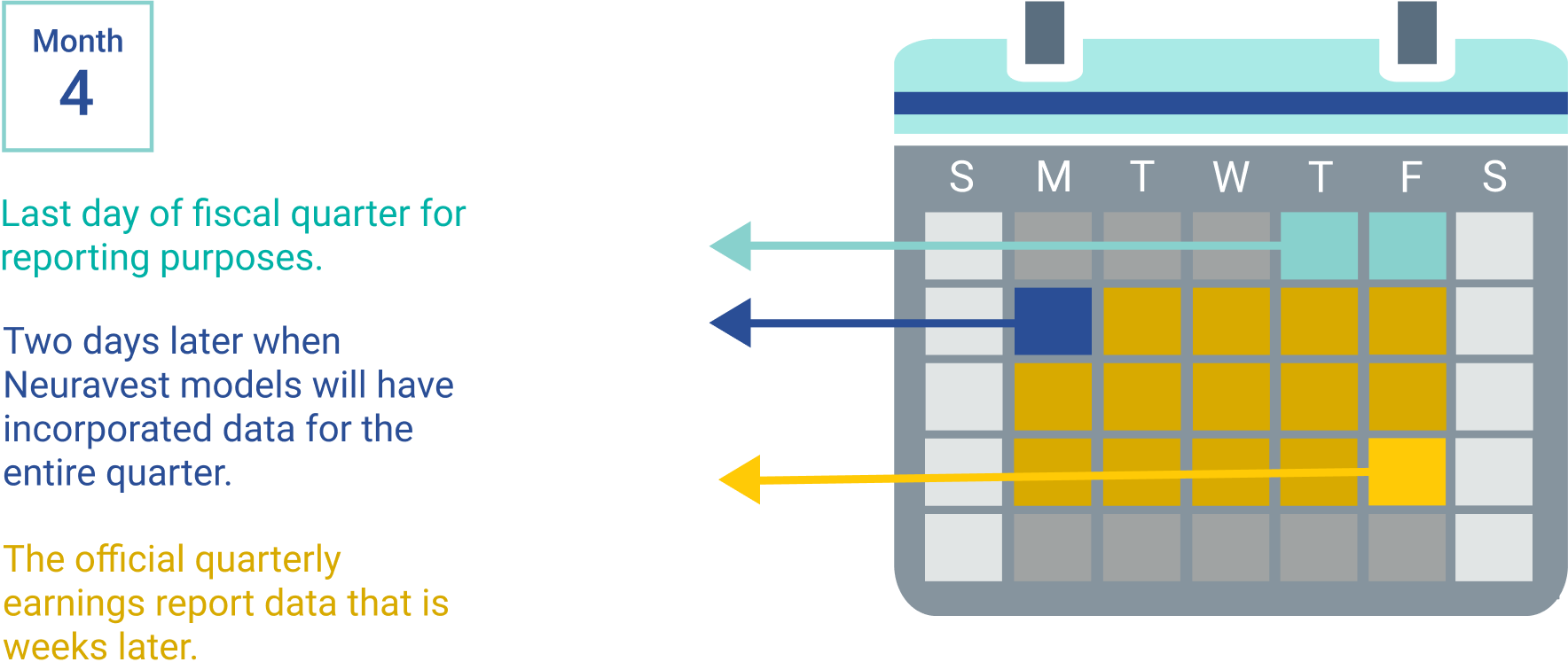

Example:

Monday = Consumer swipes card to make purchase

Wednesday = Neuravest implements fresh data into models